ePayables 101 – More Metrics

Today we’ll look at the other key metrics (besides the average cost per invoice discussed last time) that can help an AP department better understand its baseline performance and better make a case for transformation. For the purposes of this series and this article, I am focusing on the metrics that will help build a business case for an investment in ePayables solutions, not operational metrics. Operational metrics are certainly important and if accurately tracked and presented to finance executives, they can be a powerful way to engage the larger finance team (Sidebar: If you are going to start delivering reports to executives, bend over backwards to make them crisp and clear. More often than not, the format and packaging in executive reporting will be as important as the contents in how they are evaluated (meaning the quality of the reporting job, not the metrics themselves) – the same holds very true when talking about the reporting layout in software systems.).

Again, last time we focused on the (average) cost per invoice which is the all-in annual AP departmental cost (which include payroll, operating expenses, allocated overhead, etc) divided by the total number of invoices processed in the year. It’s the metric that boils down AP efficiency in a clean and clear way (If after reading this post, calculating your average cost per invoice proves too difficult, we’ve suggested using Processed Invoices per FTE (full-time equivalent) as a proxy for cost per invoice).

Additionally, there are several underlying “accuracy” metrics that are solid drivers of improving efficiency and lowering the average cost per invoice – exceptions being the big one on the processing side and payment errors (duplicate payments or over-payments typically) on the payment side. As such, efforts should be made to track and improve these numbers, even if they are not a core part of the business case.

Beyond the process efficiency gains as captured by the average cost per invoice, the other primary areas with quantifiable metrics that can help drive a business case are related to cash management. Optimizing working capital can have real and very tangible benefits to the bottom-line. At the higher level, DPO (Days Payable Outstanding) or the average number of days that it takes to pay a supplier helps Treasures, CFO, analysts, and investors understand how well a company manages its cash (by comparing DPOs of like companies) which Chris Osen knows something about. At the AP line level, cash can be impacted by (1) taking early payment discounts and (2) avoid late payment penalties (3) providing the necessary level of visibility for payables financing if appropriate. While companies can get a view as to the current level of annual late payments, fully-manual AP departments can struggle trying to determine what early pay discounts are currently being taken – in these situations, the odds are that the total captured discounts will be very small.

Of course, there are also softer benefits like enterprise-level visibility, superior customer service (for internal stakeholders and suppliers), and tighter alignment with the larger source-to-settle business process to name a few, that can be gained from an investment in an ePayables solution.

Once you have your current state metrics, the one other area that needs to be discussed is the process of making assumptions on the key value drivers for the return on investment. The big ones here are the assumed levels of user adoption and the number of suppliers enabled which can be used to help estimate the overall percentage of invoices and payments that are converted to electronic in each of the first years after ePayables deployment.

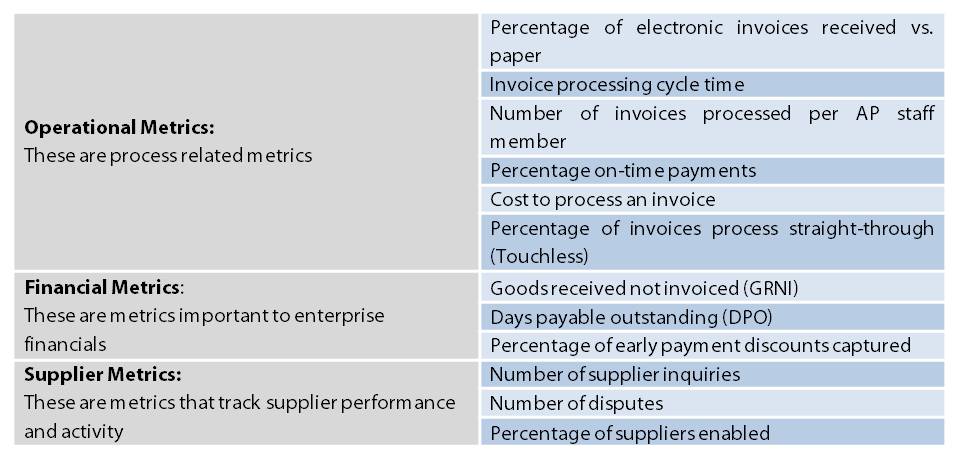

Here is a list of some of the key AP metrics to consider (this is from Ardent Partners’ new report – ePayables 2012: The State of the AP Market):

OK – we’ve concluded the ePayables 101 course material. Next time? The Final Exam! Actually, no need to study, we’ll do it for you by wrapping a bow on the whole series (found here, here, here, and here) and summarize it.